Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

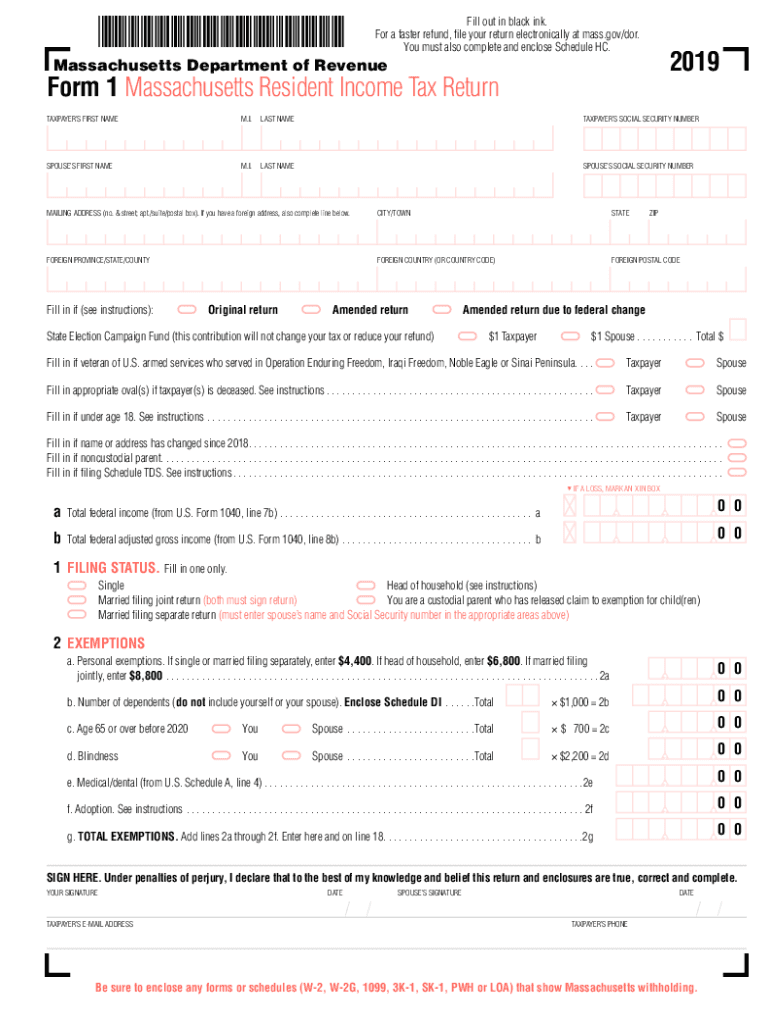

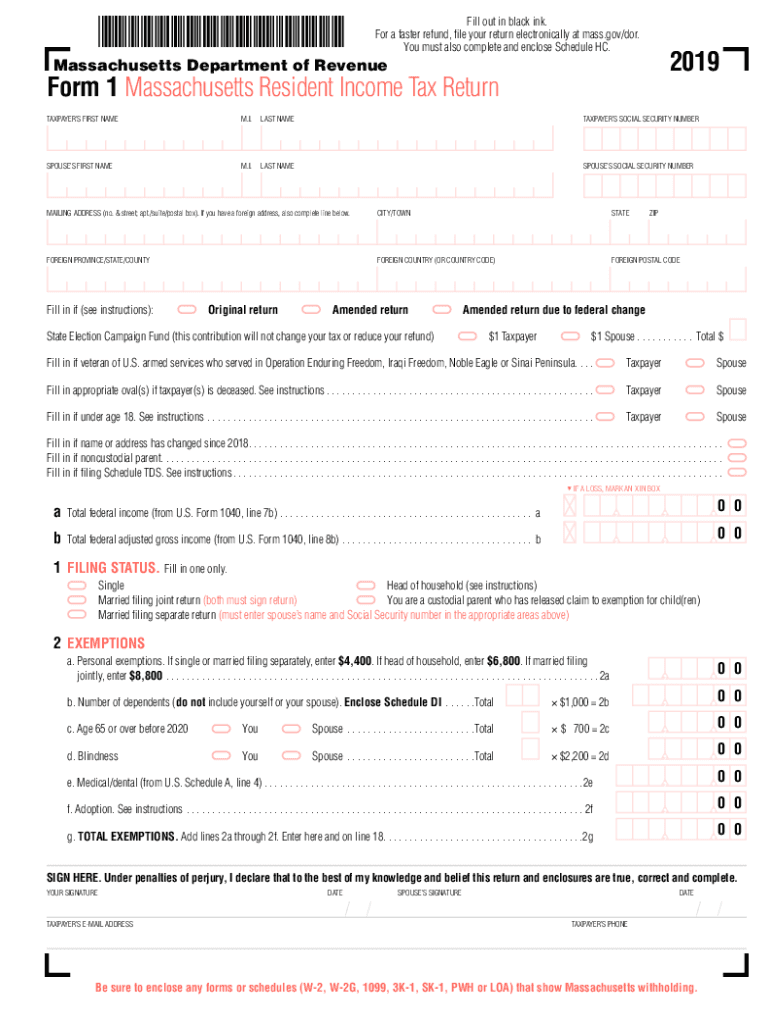

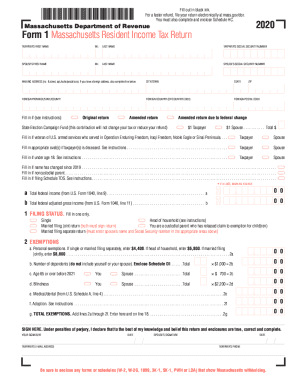

What is massachusetts state tax form?

The Massachusetts state tax form is Form 1, which is used to file a Massachusetts Resident Income Tax Return.

How to fill out massachusetts state tax form?

1. Gather the necessary information and documents you need to complete your tax return. This includes your W-2 form, 1099 forms, and any other documents that show your income, deductions, and credits.

2. Get the appropriate Massachusetts state tax form. You can find forms on the Massachusetts Department of Revenue website, or you can get them from your employer or a local library.

3. Enter your personal information, such as your name, address, Social Security number, and filing status.

4. Enter your income information, such as wages, investments, and business income.

5. Calculate your deductions and credits. Massachusetts allows a variety of deductions and credits, including medical expenses, charitable contributions, and education expenses.

6. Calculate your tax due or refund amount.

7. Sign and date the form.

8. Mail the completed form to the address listed on the form.

What is the purpose of massachusetts state tax form?

The purpose of Massachusetts state tax forms is to allow taxpayers to file their annual income taxes and pay the required state taxes. The forms help taxpayers accurately calculate their income, deductions, and credits, as well as determine their tax liability. The forms also help the state collect revenue to fund state services.

Who is required to file massachusetts state tax form?

Residents of Massachusetts are generally required to file a state tax form if they have earned income, have a gross income greater than a certain threshold, or if they meet any other filing requirements set by the Massachusetts Department of Revenue. Non-residents of Massachusetts may also be required to file a state tax form if they earned income within the state. It is recommended to consult the official Massachusetts Department of Revenue website or a tax professional for specific filing requirements based on individual circumstances.

What information must be reported on massachusetts state tax form?

The information that must be reported on a Massachusetts state tax form includes but is not limited to:

1. Personal information:

- Full name, address, and Social Security number of taxpayer and spouse (if applicable).

2. Income:

- Wages, salaries, tips, and other compensation earned during the tax year.

- Self-employment income.

- Rental income.

- Interest, dividends, and capital gains.

- Income from partnerships and S corporations.

- Unemployment compensation.

3. Deductions:

- Federal income tax deduction.

- Massachusetts Health Insurance Premiums Deduction.

- Contributions to certain retirement savings plans (e.g., IRAs).

- Deductions for qualified education expenses.

4. Credits:

- Earned Income Credit (EIC).

- Child and Dependent Care Credit.

- Residential Energy Credit.

- Senior Circuit Breaker Credit.

- Savers Credit.

- Medical expenses credit (for certain long-term care services).

5. Withholdings and estimated payments:

- Amounts withheld for Massachusetts income tax throughout the year.

- Estimated tax payments made.

6. Other information:

- Massachusetts use tax owed on out-of-state purchases.

- Health insurance coverage details.

- Household employment information (e.g., domestic workers).

It's important to note that this list is not exhaustive, and taxpayers may be required to report additional information based on their specific circumstances. It is highly recommended to consult the official Massachusetts Department of Revenue website or a tax professional for the most up-to-date and accurate information related to filing state taxes in Massachusetts.

When is the deadline to file massachusetts state tax form in 2023?

The deadline to file Massachusetts state tax forms in 2023 is typically April 17th, unless that date falls on a weekend or holiday. In such cases, the deadline may be extended to the next business day. However, it's always advisable to check with the Massachusetts Department of Revenue or consult a tax professional for the most accurate and up-to-date information.

What is the penalty for the late filing of massachusetts state tax form?

The penalty for late filing of Massachusetts state tax form is 1% of the unpaid tax per month or part of a month, up to a maximum of 25% of the unpaid tax. Additionally, there is an interest charged on the unpaid tax at a rate determined by the Massachusetts Department of Revenue.

How can I modify massachusetts state tax form 2021 without leaving Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including massachusetts form 1 fillable pdf, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

Can I create an electronic signature for the form ma tax in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your ma fillable forms in seconds.

Can I edit mass form 1 on an iOS device?

You certainly can. You can quickly edit, distribute, and sign ma form 1 on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.