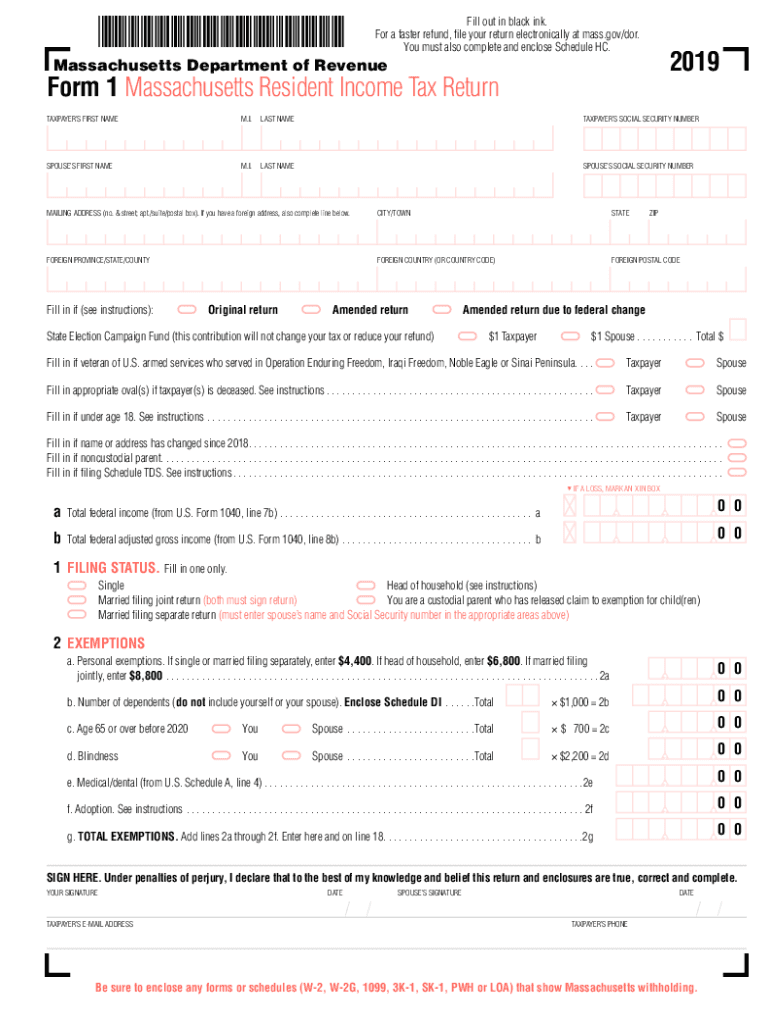

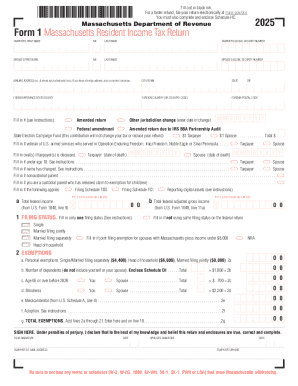

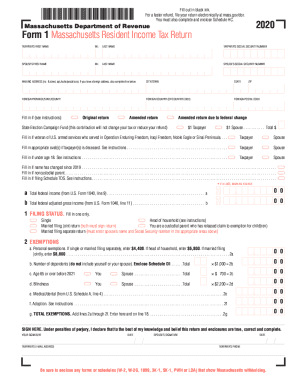

What is MA Form 1?

MA Form 1 is a state tax form used by residents of Massachusetts to report their annual income. This form is essential for determining the amount of state tax owed or the refund due based on the taxpayer’s financial situation in the specified tax year.

Who needs the form?

MA Form 1 is required for Massachusetts residents who earn income within the state. This includes individuals with jobs, self-employment income, and other sources of taxable income. Additionally, part-year residents and those claiming certain deductions must also file this form.

Components of the form

MA Form 1 consists of various sections including personal information, income reporting, and tax calculations. Key components typically include the taxpayer's name, Social Security number, filing status, total income, and applicable deductions or credits. Each section must be filled out thoroughly to ensure correct processing.

What payments and purchases are reported?

MA Form 1 requires reporting of various income sources, including wages, interest, dividends, and capital gains. The form also includes sections for itemizing deductible expenses, such as student loan interest and mortgage interest. Accurately reporting all relevant income and deductions impacts tax liability.

What are the penalties for not issuing the form?

Failing to submit MA Form 1 can result in significant penalties, including fines and interest on unpaid taxes. The Massachusetts Department of Revenue actively enforces compliance and may pursue additional legal actions against individuals who do not file required tax documents. Always ensure timely and accurate filing to avoid such penalties.

Is the form accompanied by other forms?

MA Form 1 may need to be accompanied by additional forms depending on your circumstances. For example, if you are claiming specific credits, you may need to include relevant schedules or addenda. Check the Massachusetts Department of Revenue guidelines for any required supporting documentation.

What is the purpose of this form?

The purpose of MA Form 1 is to calculate an individual’s state income tax liability in Massachusetts. It enables the Department of Revenue to assess income, deductions, credits, and ultimately, tax obligations. Accurate filing is crucial to ensure compliance with state tax laws.

When am I exempt from filling out this form?

You may be exempt from filling out MA Form 1 if your total income is below the Massachusetts filing threshold. Special exemptions may apply for certain individuals including those with only tax-exempt income or if you are dependent on someone else's return. Always verify your eligibility based on your financial circumstances.

Due date

The due date for filing MA Form 1 generally aligns with the federal tax deadline, which is April 15th of each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Timely submission is essential to avoid penalties and interest.

How many copies of the form should I complete?

Typically, you must complete one copy of MA Form 1 for submission to the Massachusetts Department of Revenue. However, you may want to keep a personal copy for your records. Ensure that all necessary attachments and additional forms accompany your submission if applicable.

What information do you need when you file the form?

When filing MA Form 1, you will need several pieces of information: your social security number, income records (W-2s, 1099s), documentation for any deductions or credits, and bank account details if opting for direct deposit. Having this information handy will streamline the filing process.

Where do I send the form?

Completed MA Form 1 should be sent to the Massachusetts Department of Revenue. The mailing address is typically provided on the form itself or on the Massachusetts Department of Revenue website. Ensure proper mailing to avoid delays or misdirection of your tax submission.